Mileage tracking is an important administrative duty for various reasons as a private investigator. While keeping track of mileage can be a relatively simple task, let’s get into the reason tracking is important and answer frequently asked questions about mileage tracking for private investigators.

Contents

- 1 Why is tracking mileage important for Investigators?

- 2 Mileage Tracking is Important for Tax Purposes

- 3 What if I’m an employee of a Private Investigation Company? How do I write off my mileage?

- 4 Billing Your Clients Accurately

- 5 Business Related Mileage You Can Track and Write off

- 6 Why Do Private Investigators Charge for Mileage

- 7 Oil Changes

- 8 Gas

- 9 General Vehicle Maintenance (Wear and Tear)

- 10 At What Point to Investigators Charge for Mileage

- 11 What is the Rate Private Investigators Charge for Mileage

- 12 Making it Clear to the Client What They are being Charged For

- 13 What do you use to Track Mileage?

- 14 Spread Sheet Mileage Tracking

- 15 Mileage Tracking Notebook

- 16 Mileage Tracking Apps

- 17 MileIQ

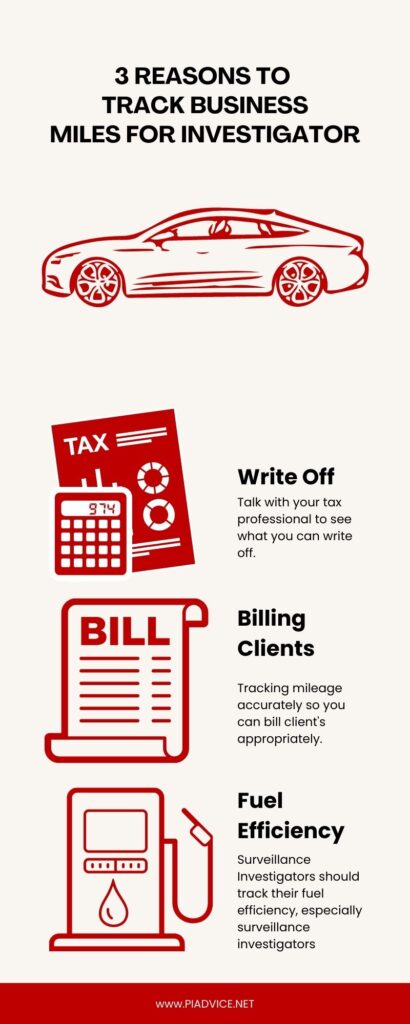

Why is tracking mileage important for Investigators?

Mileage Tracking is Important for Tax Purposes

While I am not an accountant or a tax professional, business-related mileage can translate into write-off opportunities for your business or an employee of a business. For 2022 according to the IRS website, business owners can deduct 58.5 cents a mile traveled. Most investigators travel between 20,000 and 30,000 miles a year. At the 30,000 mark, it adds up to $17,550 of possible deductions (assuming you are not compensated for these miles).

What if I’m an employee of a Private Investigation Company? How do I write off my mileage?

It has been said that if you are not reimbursed the full amount designated by the IRS, you can write off the difference. For example, if the rate for that tax year is 58.5 cents a mile and you are reimbursed 35 cents a mile by the company you work for, then you can write off 23.5 cents a mile. Please check with your tax professional to see if that is still the case.

Billing Your Clients Accurately

If you are billing your clients per mile for investigative work, it is important that you are not guessing at the mileage. You should be able to itemize your business-related trips if a client requests that information if you want to maintain the integrity of your billing.

Business Related Mileage You Can Track and Write off

Again, verify with your tax professional for clarification, but generally speaking, the types of mileage you can write off that is business-related can relate to the following:

- Traveling to and from a Surveillance Assignment

- Traveling to and from any Investigation Assignment

- Traveling to and from a business meeting

- Mileage During a Surveillance Assignment

- Business Meetings (to and from)

- Trips to Mail Business Related Parcels (to and from)

- Any Other Business-Related Travel

Why Do Private Investigators Charge for Mileage

Not all private investigators charge mileage to their clients for investigation work but many do. Companies charge for mileage to cover expenses unrelated to actual investigation time like the following:

Oil Changes

One of the reasons investigators charge mileage is to cover wear and tear on their vehicles. Investigators travel a great deal for investigation work which naturally will increase the frequency investigators may need to pay for maintenance work on their vehicle. Instead of the normal frequency of many people that get oil changes, investigators may be required to get one every 1 to 2 months.

Gas

Generally speaking, investigators fill up their vehicles every day they have a surveillance assignment. Gas in 2022 averages over $4.00 a gallon. Filling up the average SUV runs between $70 and $80 in most places. Charging for mileage helps cover the cost of gas for private investigators.

General Vehicle Maintenance (Wear and Tear)

Charing for mileage allows for investigators to have money to go towards general maintenance including repairs and replacement of tires.

At What Point to Investigators Charge for Mileage

I alluded that some investigators don’t charge for mileage at all. This is a case-by-case situation in that investigators have discretion as business owners to decide.

Some investigators charge an all-inclusive hourly rate to simplify billing purposes for their clients.

Many investigators will only charge mileage during the investigative time. For instance, once the investigator arrives at a surveillance location the investigator will begin tracking until the conclusion of surveillance efforts for that day.

Many investigators charge mileage time from the time they leave their home until the time they return home from an assignment.

An easy way that some investigators to document this is by videotaping their odometer when departing their residence or office and again when they arrive at the surveillance location. Investigators will then videotape their odometer when surveillance efforts for that day come to a conclusion and again when they arrive back at their home or office.

What is the Rate Private Investigators Charge for Mileage

Generally speaking, investigation business owners don’t charge anything less than .50 cents a mile in the current climate of the economy up to the rate stated by the IRS. Investigators could go beyond those numbers but they risk pricing themselves out of the market depending on the assignment.

This cost of an investigation assignment could go up very quickly depending on the type of assignment and distance the assignment is from the investigator.

If an investigator is 70 miles from a surveillance assignment and is charging too much for mileage, the client may attempt to find another investigator that is closer to the assignment to save money. If this happens, the investigator that is 70 miles away may lose good work over a mileage charge.

Making it Clear to the Client What They are being Charged For

Regardless of whether you charge for mileage or how you charge mileage to your client (if at all); be sure to make it clear what the client is being charged for during the investigation. This can be laid out in the retainer agreement in a clear way so there are no surprises to the client.

If you are hiring a private investigator, the same recommendation would be for you as well. Make sure the investigator you are hiring is very specific about what you are being billed for during the course of the investigation.

What do you use to Track Mileage?

There are several ways you can keep track of your mileage. No matter what way you choose to do it, being consistent with your tracking is the most important part. Here are a few ways investigators keep track of their mileage.

Spread Sheet Mileage Tracking

These three spreadsheets all work very similarly. These spreadsheets can be accessed from apps on your phone or tablet. Google Sheets is part of the Google suite of apps and is free for any device. Many investigators that use Google Sheets also use Google Slides and Google Docs along with many other Private Investigator Apps.

Mileage Tracking Notebook

Many investigators like to track mileage on paper and that is where a mileage notebook can come in handy. If writing things down is your jam, then picking up a mileage tracking notebook is the way to go.

Mileage Tracking Apps

There are many mileage tracking apps on the market that track your mileage and trips without you having to worry about logging it down each time you leave for a business trip. If this seems more like the way for you to go, then check out these mileage apps.

MileIQ

I discussed this app before in the article about private Investigator Apps as I have used this app in the past to track mileage. This app gives you the ability to review trips you have made and identify them as business or personal trips after the trips have already been taken. When I used it years ago I noticed it did not track trips when I was using Google Maps on my phone. Hopefully, this glitch has been updated. Give it a shot and see if it is a good fit for you.

Other apps to consider are:

Some of these applications are subscription-based and go above and beyond just simply tracking mileage.

Tracking mileage in a business doesn’t have to be difficult but it is important when it comes to taxes and clients. If you found this article useful, be sure to share it with others. See you in the next one!

Recent Posts

Hawaii is probably one of the most interesting states to work as a private investigator if you are not used to the culture or a native of the state. And if you are not a local, that is something...

How to become a private investigator in Georgia