With advancements in technology, insurance investigators have had increased difficulty in some areas of investigation while having it easier in other areas of investigation simultaneously. Video recording devices have become smaller and devices are able to record longer than ever. With all those advancements available one thing that hasn’t changed for insurance investigators are privacy laws. Do insurance companies use drones to spy on claimants? The answer to that is no.

Using a drone to conduct surveillance is not practical, not cost-effective, not legal in many states, and could be considered an invasion of privacy in many situations.

Utah Code § 76-6-206 (2022) for instance indicates that a drone being flown over private property is considered criminal trespass. Utah’s criminal trespass includes flying a drone over a fenced area as that would imply an expectation of privacy.

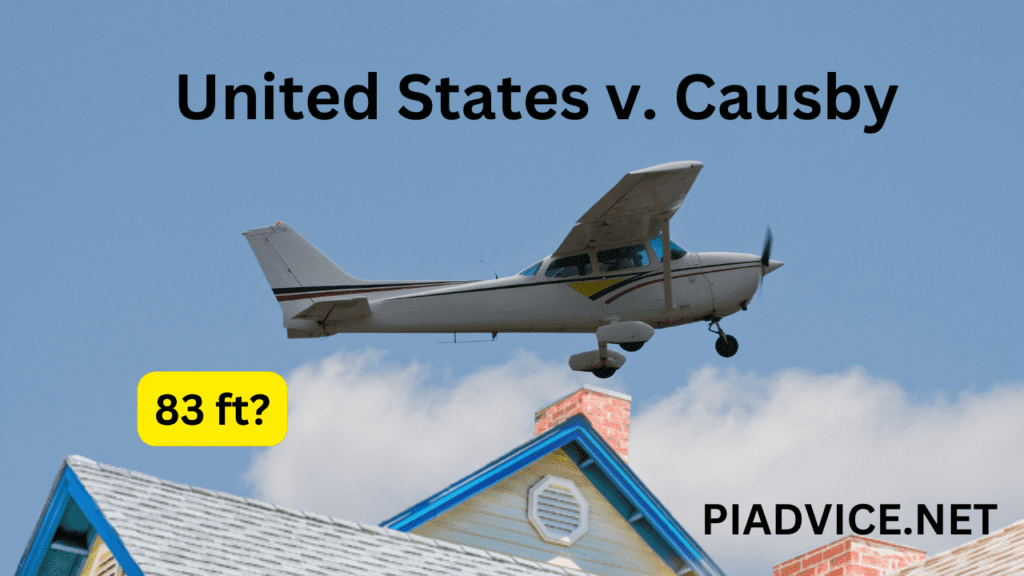

The Supreme Court in the case in 1946, United States v. Causby, an individual owned a farm that had chickens on it. The flight path to an airport was 83 feet above the respondent’s residence and due to military planes flying extremely low above the farm, chickens died and the owner’s lost sleep, nervousness, and were frightened.

The ruling basically determined that we as home and property owners own at least 83 feet above our properties per the judgment of this court case.

In most cases, aircraft and not fly below 500 feet in non-congested areas and 1000 feet in congested areas over the highest obstacle.

There are gray areas between 83 feet and 500 feet as to what can be flown in this area. Drones can not fly above 400 feet which provides 100 feet of buffer between the lowest altitude aircraft can fly.

Contents

- 1 Why Do Insurance Companies Conduct Surveillance?

- 2 What Are The Different Types of Surveillance an Insurance Investigator Can Conduct?

- 3 Stationary Surveillance

- 4 Mobile Surveillance (Moving Automobile Surveillance)

- 5 Covert Surveillance

- 6 Remote Surveillance

- 7 Unmanned Surveillance

- 8 How Do Insurance Companies Use Drones?

- 9 Aerial Property Documentation

- 10 Roof Inspections Using Drones

- 11 Property Damage Inspection Using Drones

- 12 What is the Future for Drones and Insurance Companies?

Why Do Insurance Companies Conduct Surveillance?

Insurance fraud is over a 300 billion dollar issue every year in the United States. Insurance companies have the legal right and obligation to investigate insurance claims that could potentially be fraudulent. Insurance companies are vigilant in fighting fraud as the cost of fraud is passed on to insured individuals.

Insurance companies look for red flags that could potentially be indicators of fraud. Once red flags are identified they are investigated to have a clear view of a given insurance claim. Many times fraud of some degree is revealed and other times the investigation results in confirming the insurance claims are legitimate and clarifying any concerns the insurance company may have had about a claim.

What Are The Different Types of Surveillance an Insurance Investigator Can Conduct?

Insurance companies enlist the assistance of insurance investigators (private investigators) to help with investigating insurance claims. Insurance investigators conduct different types of surveillance which include the following:

Stationary Surveillance

Stationary surveillance conducted by a private investigator is when a private investigator is in a fixed position when conducting surveillance. This type of surveillance is conducted approximately 99 percent of the time within a vehicle and is intermingled with other forms of surveillance which you will read about below.

When a private investigator arrives at a surveillance location, they establish a discreet stationary surveillance position at the location they are conducting surveillance on. This position is maintained until mobile surveillance is required due to the subject of an investigation departing the area.

Mobile Surveillance (Moving Automobile Surveillance)

Mobile Surveillance or Moving Automobile Surveillance is surveillance that is conducted when following a subject in a vehicle. Insurance investigators (private investigators) following a claimant does so in their vehicle and follow them to different locations and document their activities via camcorders.

In many instances, after the claimant arrives at a location the investigator will follow them into a store, restaurant, or business to conduct covert surveillance of their activities using covert spy cameras.

Covert Surveillance

Insurance investigators conduct covert surveillance with the use of spy cameras in areas where a camcorder would bring attention to the investigator.

Investigators have been known to use cell phones, key chain cameras, spy pen cameras, spy glasses, and other covert devices to document the activities of individuals while remaining undetected.

Remote Surveillance

Remote Surveillance is when insurance investigators use surveillance devices in public areas that don’t require an investigator present however the investigator can view the video recorder live for nearly a week at a time.

The devices used are covert, and require a large battery to power the device. An air card gives the recording device the capability of connecting to applications for the investigator to observe activity in real time without being present at the surveillance site.

These devices have limitations of course but can be an alternative in specific types of investigations to assist the insurance investigator with a surveillance assignment.

Unmanned Surveillance

There are situations similar to remote surveillance, to maintain the integrity of an investigation, the investigator can not be present on site.

Cameras that can record for extended durations are placed in vehicles with a view of a location. The cameras can record the location without the need for an investigator in the vehicle for days at a time.

When appropriate, the investigator will return to the vehicle discreetly and depart the area with the vehicle.

This type of surveillance is used for various reasons including trying to determine the comings and goings of a residence or given location without using insurance investigators around the clock which can be costly.

How Do Insurance Companies Use Drones?

Investigators have claimed to use drones for surveillance purposes for years since drones first started becoming popular in the early 2010s. The reality of drone usage, however, is not practical in the majority of surveillance investigations despite technological advancements. Despite claims by attorneys, insurance companies are not using them for surveillance.

Expectations of privacy are concerns for investigators as a whole. Drones that hover over properties that is not easily visible from plain view open an insurance company and insurance investigator to liability.

So that we have established that insurance companies and insurance investigators are not using drones for surveillance purposes, the question is, how are they using drones? Here is a list of ways insurance companies are using drones to investigate claims.

Aerial Property Documentation

The more information an insurance company has the better when it comes to determining the outcome of an insurance claim. Trees fall, fences fall, roofs get damaged for various reasons, property gets stolen and an aerial view can provide more context for the insurance company. Recently the FAA has made it easier for insurers to use drones to survey damage in different areas.

Roof Inspections Using Drones

There are situations where it is not safe for an insurance adjuster or insurance investigator to climb on a home’s roof. Using a drone can allow for conducting an inspection quickly without causing more damage to a roof or risking the inspector getting injured while inspecting a roof.

Property Damage Inspection Using Drones

Using a drone to view the current property where damage has occurred can provide a better perspective to the insurance company along with complementing on-the-ground photos and video. While there are aerial photographs someone can find from Google Earth, an updated view of a claimant’s property could be very useful during the claim process or investigation.

What is the Future for Drones and Insurance Companies?

There is still a lot to be determine when it comes to using drones in populated areas. Advancements in drone technology are making thes unmanned aerial vehicle (UAV) much safer however privacy will always be a concern. For drone laws for specific states and counties this site will be helpful in navigating the laws where you are using a drone commecially or as a hobbiest.

Recent Posts

Hawaii is probably one of the most interesting states to work as a private investigator if you are not used to the culture or a native of the state. And if you are not a local, that is something...

How to become a private investigator in Georgia